Key Takeaways:

- USPS retirees have access to a comprehensive range of health benefits that include Medicare, supplemental insurance options, and prescription drug plans, ensuring robust healthcare coverage.

- Understanding how to navigate and optimize these benefits can significantly enhance the healthcare experience and financial security of USPS retirees.

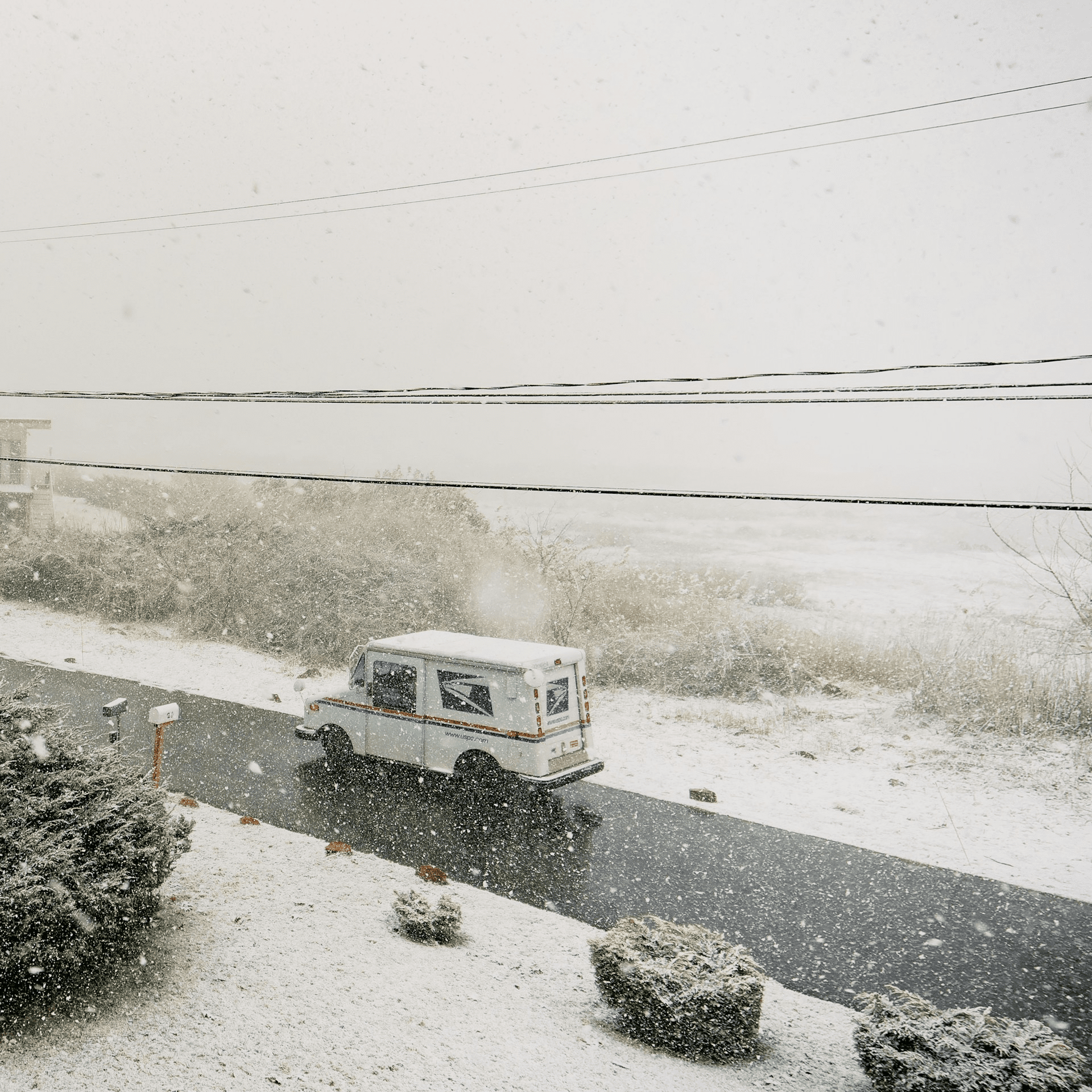

Accessing Healthcare for USPS Retirees: What’s There to Know

Accessing healthcare as a USPS retiree involves understanding the various benefits and options available to you. This guide will cover key aspects such as health benefits, Medicare enrollment, supplemental insurance choices, prescription drug plans, selecting healthcare providers, and strategies to maximize your health benefits.

Overview of Health Benefits for USPS Retirees

USPS retirees enjoy a comprehensive package of health benefits aimed at providing extensive medical coverage. These benefits include access to the Federal Employees Health Benefits (FEHB) Program, which offers a wide range of health plans, allowing retirees to choose the one that best suits their needs. The FEHB Program provides coverage for hospital and doctor visits, preventive care, mental health services, and more.

Additionally, USPS retirees are eligible for Medicare, a federal program that becomes the primary health insurance provider once you turn 65. The combination of FEHB and Medicare ensures that retirees have robust coverage, reducing out-of-pocket costs and providing peace of mind.

Medicare Enrollment Guide for USPS Retirees

Medicare is a critical component of healthcare for USPS retirees. Enrollment typically begins three months before your 65th birthday and extends to three months after. Understanding the parts of Medicare is essential:

- Medicare Part A (Hospital Insurance): Covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Most retirees receive Part A premium-free.

- Medicare Part B (Medical Insurance): Covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Part B requires a monthly premium.

- Medicare Part C (Medicare Advantage): An alternative to Original Medicare that allows you to choose a plan offered by a private company, covering all Part A and Part B services and often including Part D (prescription drug coverage).

- Medicare Part D (Prescription Drug Coverage): Helps cover the cost of prescription drugs.

It is important to sign up for Medicare Part A and Part B when you are first eligible, as delaying enrollment can result in higher premiums.

Supplemental Insurance Choices for Retirees

While Medicare provides extensive coverage, it does not cover everything. Supplemental insurance, or Medigap, can help fill the gaps. Medigap policies, sold by private companies, can cover costs such as copayments, coinsurance, and deductibles that Medicare does not. There are ten standardized Medigap plans available, each offering different levels of coverage.

Additionally, USPS retirees can opt for FEHB plans that coordinate with Medicare. Many FEHB plans offer benefits that complement Medicare coverage, such as additional coverage for prescription drugs, reduced out-of-pocket costs, and access to a broader network of providers.

When choosing supplemental insurance, it is crucial to compare the benefits, costs, and coverage options to find the plan that best meets your needs.

Understanding Prescription Drug Plans

Prescription drug coverage is a vital aspect of healthcare for USPS retirees. Medicare Part D provides prescription drug coverage through private plans approved by Medicare. Each plan varies in cost and the specific drugs covered, so it is essential to review the formulary (list of covered drugs) of any plan you are considering.

FEHB plans often include prescription drug coverage as well. If you have both FEHB and Medicare, your FEHB plan will typically act as your primary prescription drug coverage, with Medicare Part D as secondary.

When evaluating prescription drug plans, consider factors such as monthly premiums, annual deductibles, copayments, and the plan’s formulary to ensure your medications are covered at an affordable cost.

How to Choose Healthcare Providers

Selecting the right healthcare providers is crucial for maintaining good health and receiving quality care. USPS retirees have access to a wide network of providers through FEHB and Medicare. Here are some tips for choosing healthcare providers:

- Verify Network Participation: Ensure the provider is in your plan’s network to avoid higher out-of-pocket costs.

- Check Credentials: Look for board-certified providers with good standing in their field.

- Read Reviews: Patient reviews and ratings can provide insight into a provider’s quality of care.

- Consider Location: Choose providers conveniently located near your home to make appointments and follow-up visits easier.

- Evaluate Communication: A provider who communicates well and makes you feel comfortable can improve your healthcare experience.

By carefully selecting healthcare providers, you can ensure that you receive the best possible care within your plan’s network.

Getting the Most Out of Your Health Benefits

Maximizing your health benefits as a USPS retiree involves understanding and utilizing all available resources. Here are some strategies to help you get the most out of your benefits:

- Annual Wellness Visits: Take advantage of preventive care services covered by Medicare and FEHB, such as annual wellness visits, screenings, and vaccinations.

- Understand Your Coverage: Familiarize yourself with your plan’s benefits, including covered services, copayments, and deductibles, to avoid unexpected costs.

- Use In-Network Providers: Staying within your plan’s network can significantly reduce out-of-pocket expenses.

- Stay Informed: Keep up-to-date with any changes to your health benefits or plan options during the annual open season for FEHB and Medicare open enrollment periods.

- Consider Health Savings Accounts (HSAs): If you are eligible, contribute to an HSA to save for future medical expenses with tax advantages.

By actively managing your health benefits and staying informed, you can ensure comprehensive coverage and financial security.

Conclusion

Navigating healthcare as a USPS retiree involves understanding the range of benefits available, from FEHB and Medicare to supplemental insurance and prescription drug plans. Making informed choices about healthcare providers and maximizing your benefits through preventive care and staying in-network can enhance your healthcare experience and financial security. By staying proactive and informed, USPS retirees can enjoy robust health coverage and peace of mind during retirement.

Contact Information:

Email: [email protected]

Phone: 5125552345